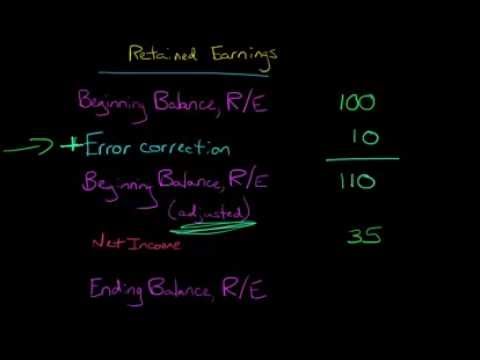

Let’s stroll through an example of calculating Coca-Cola’s actual 2022 retained earnings steadiness by using the figures of their actual financial statements. You can find these figures on Coca-Cola’s 10-K annual report listed on the sec.gov web site. Any changes or movements with net revenue will immediately impact the RE balance. Elements corresponding to an increase or decrease in web revenue and incurrence of web loss will pave the way to either enterprise profitability or deficit.

Nonetheless, company owners can use them to buy new assets like gear or inventory. Additionally, your retained earnings over a certain period won’t always present good information. For instance, say they take a look at your modifications in retained earnings through the years.

A firm might have important retained earnings whereas lacking enough money to pay dividends, as the earnings could be reinvested in assets like machinery or inventory. This distinction is vital for greedy the monetary health of a business. In a firm’s stability sheet, the retained earnings are accounted underneath the shareholders’ equity. In accounting, retained earnings are a company’s cumulative net earnings (profit) minus its dividend funds to shareholders.

Retained Earnings: Definition, Calculation, And Examples

A company shouldn’t keep away from giving dividends payouts just to amass more retained earnings. And it can pinpoint what business owners can and can’t do sooner or later. They must understand how much return they’re getting on their investment. Before you make any conclusions, understand that you may work in a mature organisation.

- When the retained earnings steadiness is lower than zero, it is referred to as an amassed deficit.

- Retained earnings may be found on the best side of a stability sheet, alongside liabilities and shareholder equity.

- Angela Boxwell, MAAT, is an accounting and finance skilled with over 30 years of expertise.

- A “good” retained earnings determine depends on the company’s trade, progress stage, and financial goals.

- The ending steadiness appears in the equity section of the steadiness sheet.

- For instance, if an organization generates $1 million in net revenue and decides to distribute $200,000 as dividends to shareholders, the remaining $800,000 is added to retained earnings.

The Most Effective Accounting Software Program For Consultants

These earnings are thought of “retained” because they have not been distributed to shareholders as dividends but have as an alternative been stored by the company for future use. Retained earnings are some of the essential indicators of a company’s monetary health. They are the stays of a company’s profits in spite of everything bills are paid. The enterprise can use the cash for future use, finance new investments or repay debt. In brief, retained earnings measure a company’s ability to generate future growth.

Retained earnings are some of the telling indicators of a company’s long-term monetary strategy and operational health. They mirror how much revenue a enterprise retains after distributing dividends, providing insights into its reinvestment priorities, funding functionality, and sustainability. To calculate the increase in a business’s retained earnings, you must https://www.simple-accounting.org/ first divide the precise accounting period’s retained earnings towards the start retained earnings of the identical interval.

Quickonomics supplies free access to education on economic matters to everyone all over the world. Our mission is to empower people to make better decisions for his or her personal success and the good thing about society. CFI is the worldwide establishment behind the financial modeling and valuation analyst FMVA® Designation.

Then multiply this quantity by a hundred to find out the share improve of your earnings within that interval. Nonetheless, web earnings, along with internet losses and dividends, immediately affects retained earnings. Internet earnings is the entire amount an organization makes after taxes and expenses. In different words, the aim of these earnings is to reinvest the money to pay for additional property of the corporate, continuing its operation and progress. Thus firms do spend their retained earnings, however on belongings and operations that further the operating of the business. We can cross-check every of the method figures used within the retained earnings calculation with the other financial statements.

With this readability, it’s easier to assess the various elements that influence retained earnings over time. If the corporate had not retained this money and as a substitute taken an interest-bearing loan, the value generated would have been less because of the outgoing curiosity fee. Retained earnings supply internally generated capital to finance tasks, allowing for efficient value creation by worthwhile corporations. However, note that the above calculation is indicative of the worth created with respect to the use of retained earnings only, and it doesn’t point out the general worth created by the corporate. Traders who look for short-term positive aspects may prefer dividend funds that provide instant features.

Instruments like HAL ERP strengthen this by automating monetary monitoring, improving decision-making, and maintaining full visibility into each SAR retained or spent. Effectively managing these influencing elements requires greater than consciousness. As corporations look to strengthen their retained earnings position, expertise becomes a critical enabler. This is the place an clever, built-in system like HAL ERP supports smarter financial practices and sustainable growth. Firms should perceive tips on how to calculate retained earnings accurately to leverage them fully. Retained earnings are the quantity a company positive aspects after the taxation of its net earnings.